Why Joe believes "your tenant is the true asset".Treating tenants like customers to reduce turnover.Why taking out a HELOC may make sense right now.Why you're likely to see more flippers leasing out houses.Learning from local investors who thrived during past crashes.The importance of a well-thought-out business plan.Why the first thing we should all do is "take a breath".Stay safe, everyone - and we'll see you next Wednesday. This episode is GOLD for investors on the hunt for their first, second, or third deal in 2020. even when you're steering into economic headwinds.

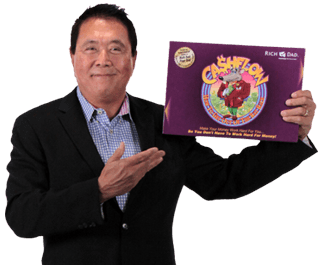

Cashflow game kiyosaki plus#

Plus - Joe breaks down how renting to Section 8 voucher holders can be a lifeline during a recession (assuming you do a few things exactly right), and Steve shares his tips for designing systems and checklists (he's a pilot after all!) so you can think clearly.

Cashflow game kiyosaki how to#

This episode covers it all - from the mindset successful investors use to accelerate wealth-building through downswings, to the shifting competition you're likely to face, to how to whip your finances into shape and secure lines of credit BEFORE you need them.

Cashflow game kiyosaki full#

Joe and Steve have a combined 50 years of experience under their belts, so they offer a valuable perspective to younger or less experienced investors - our fearless co-hosts included - who haven't yet seen a full real estate cycle. Think of it as a virtual coaching session with two seasoned, successful investors who have withstood several downturns and lived to tell about it. On Tuesday, March 17, Ashley and Felipe sat down with Joe Asamoah and Steve Rozenberg to discuss the topic on everyone's mind: the COVID-19 outbreak and its inevitable impact on real estate investors.

So - we've got a new (and very fresh) episode for you. Tell us what you think of this episode in the Real Estate Rookie Facebook group, and subscribe to the podcast in your favorite podcast app so you won't miss the next show! and you can learn a lot from his approach of looking to "get on base" rather than hit a home run right away. "Captain Tim" is a relatable, down-to-earth guy. Instead, Tim learned all he could and put together a more conservative game plan.

He had a close relative who lost out in the last downturn, so he had every reason to stay far away. Plus - if you know anyone who got burned in 2007-08. We'll cover how to manage fear when making a cold call, how to crunch the numbers using government tax records, and how to protect yourself against the worst-case scenario. What happened next? You'll hear the story in today's episode of the Real Estate Rookie Podcast. Then, after seeing a For Sale By Owner (FSBO) sign, he called the owner on the spot. He went driving for dollars in his hometown of Lake George, NY. But after taking a trip abroad to clear his head, Tim narrowed his focus and went ALL-OUT in pursuit of his first deal. Today's guest, Tim Goutos, was right there with you. Įver felt like you're close to breaking into real estate investing, but not quite getting anywhere? See Privacy Policy at and California Privacy Notice at.

0 kommentar(er)

0 kommentar(er)